- Afrikaans

- Albanian

- Amharic

- Arabic

- Armenian

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- English

- Esperanto

- Estonian

- French

- German

- Greek

- Hindi

- Indonesian

- irish

- Italian

- Japanese

- Korean

- Lao

- Malay

- Myanmar

- Norwegian

- Norwegian

- Polish

- Portuguese

- Romanian

- Russian

- Serbian

- Spanish

- Swedish

- Thai

- Turkish

- Ukrainian

- Uzbek

- Vietnamese

Srp . 30, 2024 06:53 Back to list

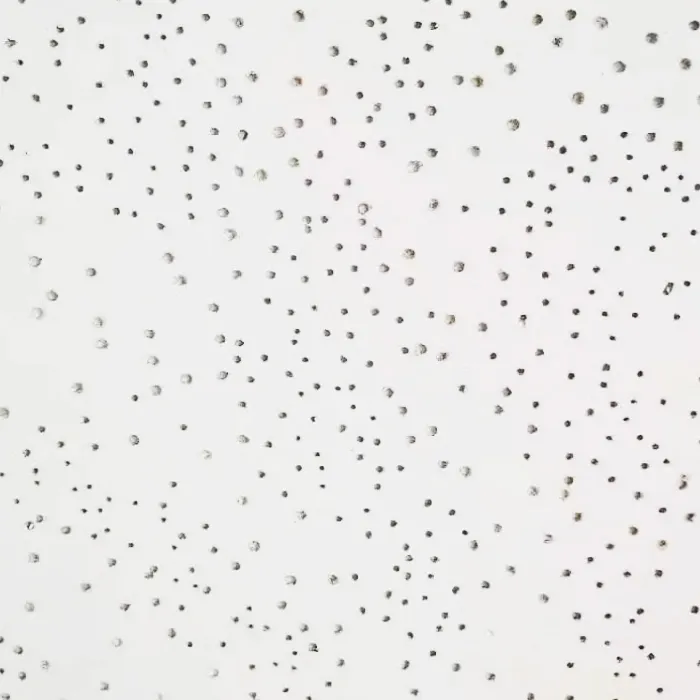

T Grid Ceiling Prices - Affordable and Quality Solutions

Understanding the T Grid Ceiling Price Implications and Benefits

In the realm of financial markets, pricing mechanisms are crucial for ensuring stability and predictability. One such mechanism that has gained attention is the concept of a grid ceiling price, often referred to in various contexts, including commodities trading, market regulation, and energy pricing. The T grid ceiling price specifically represents an upper limit established by regulatory authorities or market designers to control price volatility and protect consumers from excessive costs.

What is a Grid Ceiling Price?

A grid ceiling price is essentially a predetermined maximum price point for a specific product or service within a market. This ceiling is designed to prevent prices from soaring beyond a reasonable level, thereby safeguarding consumers and ensuring equitable access to essential goods and services. It is particularly relevant in markets characterized by extreme fluctuations due to supply-demand imbalances, geopolitical factors, or environmental influences.

For instance, in energy markets, a grid ceiling price may be established to prevent electricity prices from escalating during peak demand times. This regulation not only shields consumers from potential financial strain but also promotes the responsible use of resources. Similarly, in agricultural markets, implementing a grid ceiling price can protect farmers and consumers by stabilizing prices for essential food items.

Implications of Implementing a Grid Ceiling Price

t grid ceiling price

Implementing a T grid ceiling price can have far-reaching implications. Firstly, it creates a safety net for consumers, allowing them to budget effectively without fear of sudden price hikes. This stability can be particularly crucial during times of economic uncertainty or crisis, as consumers can rely on predictable pricing, which fosters confidence in the market.

Moreover, a grid ceiling price can encourage competition among producers. When prices are capped, businesses are incentivized to innovate and reduce operational costs to maintain profitability while adhering to the price limit. This can lead to improved services and products for consumers as companies strive to differentiate themselves in a constrained pricing environment.

However, there are potential downsides to consider. A grid ceiling price can sometimes lead to market distortions, where suppliers may reduce production due to diminished profit margins. This scenario can create shortages if the supply-side fails to meet demand, counteracting the initial protective intentions of a ceiling price. Therefore, it is crucial for regulatory authorities to regularly assess the implications of such price ceilings to ensure they do not inadvertently harm the market.

Conclusion

In conclusion, the T grid ceiling price serves as a vital tool in managing price stability within various markets. By setting an upper price limit, regulators can protect consumers and encourage competition while being aware of the potential downsides of market distortions. As markets continue to evolve, regulatory frameworks must adapt to find the right balance, ensuring that protective measures like grid ceiling prices not only serve immediate needs but also foster a resilient and competitive marketplace in the long term.

-

Mineral Fiber Ceiling Tiles Embossed Surface PatternNewsAug.05,2025

-

Mineral Fiber Board Xingyuan Vision for Better SpacesNewsAug.05,2025

-

Drop Down Ceiling Tile Office Use FitNewsAug.05,2025

-

PVC Gypsum Ceiling White Base ColorNewsAug.05,2025

-

Access Panel on Ceiling Xingyuan Integrity EthicNewsAug.05,2025

-

Ceiling Trap Doors Fire Resistant DesignNewsAug.05,2025